Hey there, tax warrior! If you're reading this, chances are you're trying to figure out how much you owe—or might owe—for the 2021 tax year. Let’s face it, taxes can feel like a labyrinth, but don’t worry, we’ve got you covered. A 2021 tax estimator is your secret weapon to simplify the chaos and get a clearer picture of your financial obligations. Whether you’re a seasoned taxpayer or a newbie just dipping your toes in the water, this guide will help you navigate the murky waters of tax season with confidence.

Now, before we dive headfirst into the world of deductions, credits, and brackets, let’s set the stage. The 2021 tax year brought with it some significant changes—thanks to the pandemic and various government relief programs. That means the rules of the game have shifted slightly, and having a reliable tax estimator can make all the difference in avoiding costly surprises when April rolls around.

So, buckle up because we’re about to break down everything you need to know about using a 2021 tax estimator. From understanding the basics to uncovering hidden deductions, we’ll walk you through each step so you can feel like a tax ninja by the end of this article. Ready? Let’s go!

Read also:James Spader The Dynamic Actor Who Brings Characters To Life

Why You Need a 2021 Tax Estimator

Alright, let’s cut to the chase. Why should you even bother with a 2021 tax estimator? Well, here’s the deal: taxes don’t play around. Without a solid plan, you could end up overpaying—or worse, underpaying and facing penalties. A tax estimator acts as your personal financial crystal ball, helping you predict your tax liability and plan accordingly. It’s like having a GPS for your money, steering you away from potential potholes and keeping you on track.

How a 2021 Tax Estimator Works

So, how exactly does a 2021 tax estimator work its magic? Think of it as a digital wizard that crunches numbers based on your income, deductions, credits, and filing status. You input your financial info, and voilà! It spits out an estimate of what you might owe—or what you might get back in a refund. It’s not rocket science, but it sure feels like it when you see all those numbers align.

Step-by-Step Guide to Using a Tax Estimator

Ready to roll up your sleeves and give it a try? Here’s a quick step-by-step guide:

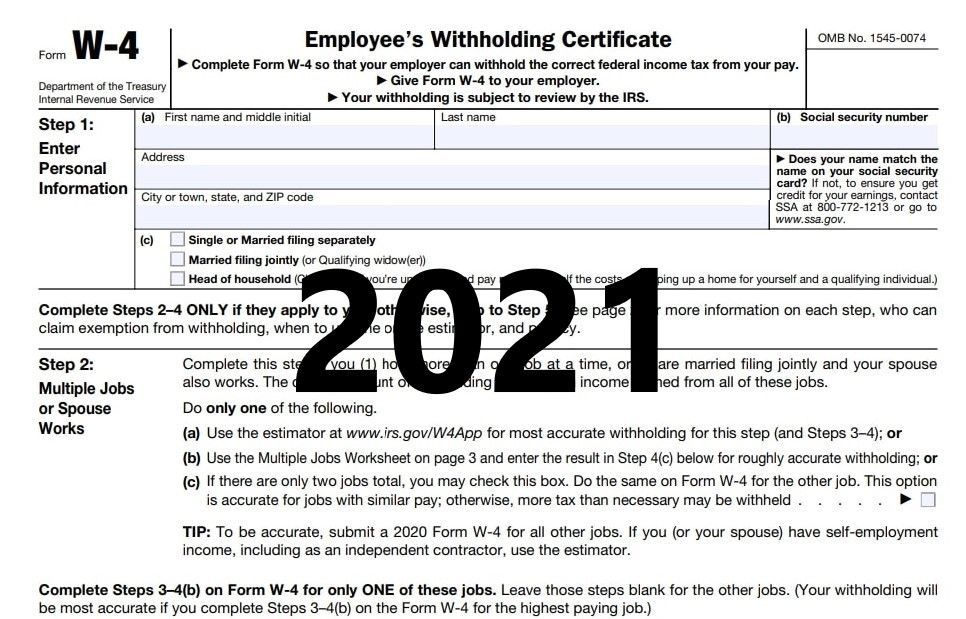

- Gather your financial documents—W-2s, 1099s, receipts for deductions, etc.

- Choose a reliable tax estimator tool (we’ll cover some options later).

- Input your personal info, including filing status, dependents, and income sources.

- Add any applicable deductions and credits you’re eligible for.

- Hit the “calculate” button and let the estimator do its thing!

Simple, right? Now, let’s dig a little deeper into the specifics.

Key Features to Look for in a 2021 Tax Estimator

Not all tax estimators are created equal. When you’re shopping around for the perfect tool, keep an eye out for these key features:

- Accuracy: You want a tool that’s up-to-date with the latest tax laws and changes for the 2021 tax year.

- User-Friendliness: The last thing you need is a complicated interface that makes you want to tear your hair out. Look for something intuitive and easy to navigate.

- Comprehensive Coverage: Make sure the estimator accounts for all relevant factors, like deductions, credits, and different types of income.

- Privacy: Your financial info is sensitive stuff, so ensure the tool uses secure encryption to protect your data.

Now that you know what to look for, let’s explore some of the best options out there.

Read also:Notti Osama The Rising Star Whorsquos Making Waves In The Music Scene

The Best 2021 Tax Estimator Tools

There’s no shortage of tax estimator tools on the market, but not all of them deliver the goods. Here are a few top contenders:

TurboTax TaxCaster

TurboTax’s TaxCaster is a fan favorite for a reason. It’s user-friendly, accurate, and packed with features to help you get a precise estimate. Plus, it integrates seamlessly with TurboTax’s full suite of tax preparation tools if you decide to file through them.

IRS Withholding Estimator

Direct from the source, the IRS Withholding Estimator is a free tool that helps you adjust your withholding and estimate your tax liability. While it’s not as flashy as some of the commercial options, it gets the job done and keeps you in compliance with Uncle Sam’s rules.

H&R Block Tax Estimator

H&R Block’s estimator is another solid choice, offering a balance of simplicity and functionality. It’s great for those who want a straightforward tool without all the bells and whistles.

Each of these tools has its strengths, so your choice will depend on your specific needs and preferences.

Common Deductions and Credits for 2021

Now, let’s talk about the good stuff—deductions and credits. These are your golden tickets to reducing your tax liability and keeping more of your hard-earned cash. Here are some of the most common ones for the 2021 tax year:

- Standard Deduction: For 2021, the standard deduction amounts were $12,550 for single filers and $25,100 for married filing jointly.

- Child Tax Credit: This one was a big deal in 2021, with an expanded credit of up to $3,600 per qualifying child.

- Earned Income Tax Credit (EITC): If you have low to moderate income, you might qualify for this valuable credit.

- Home Office Deduction: If you worked from home in 2021, this deduction could be a game-changer.

Make sure to explore all the deductions and credits you’re eligible for to maximize your savings.

Understanding Tax Brackets for 2021

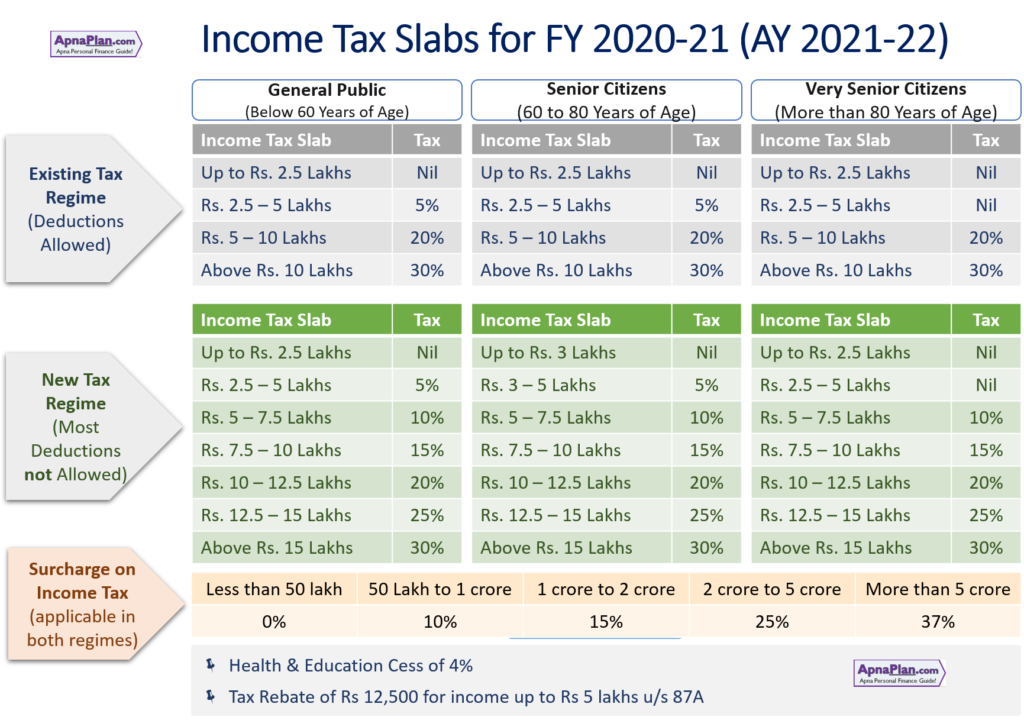

Tax brackets are another crucial piece of the puzzle. For 2021, the federal income tax brackets ranged from 10% to 37%, depending on your income and filing status. Here’s a quick breakdown:

- 10% bracket: Up to $9,950 for single filers

- 12% bracket: $9,951 to $40,525 for single filers

- 22% bracket: $40,526 to $86,375 for single filers

- And so on...

Remember, your tax bracket doesn’t determine your entire tax bill—it’s just the rate applied to the last dollar of your income. Confusing, right? That’s why a tax estimator can be such a lifesaver.

Common Mistakes to Avoid

Even the best tax warriors can stumble sometimes. Here are a few common mistakes to watch out for:

- Forgetting to account for all sources of income.

- Overlooking deductions and credits you might qualify for.

- Using outdated or inaccurate information.

- Not double-checking your calculations.

Stay vigilant and double-check everything to avoid these pitfalls.

How to Plan Ahead for Future Tax Years

Taxes aren’t a one-and-done deal—they’re an ongoing journey. To set yourself up for success in future tax years, consider these tips:

- Keep meticulous records of your income and expenses.

- Stay informed about changes in tax laws and regulations.

- Regularly review your withholding and adjust as needed.

- Explore opportunities to reduce your taxable income, like contributing to retirement accounts.

A little planning now can save you a lot of headaches down the road.

Final Thoughts: Take Control of Your Taxes

There you have it—a comprehensive guide to using a 2021 tax estimator and mastering your taxes like a pro. Remember, knowledge is power, and having the right tools at your disposal can make all the difference. So, take a deep breath, roll up your sleeves, and tackle those taxes with confidence.

And hey, don’t forget to share this article with your friends and family who might find it helpful. The more people we can empower to take control of their finances, the better. Now, go forth and conquer those taxes!

Table of Contents

- Why You Need a 2021 Tax Estimator

- How a 2021 Tax Estimator Works

- Key Features to Look for in a 2021 Tax Estimator

- The Best 2021 Tax Estimator Tools

- Common Deductions and Credits for 2021

- Understanding Tax Brackets for 2021

- Common Mistakes to Avoid

- How to Plan Ahead for Future Tax Years

- Final Thoughts: Take Control of Your Taxes