Hey there, finance-savvy buddy! If you're diving into the world of prepaid debit cards, you're not alone. Millions of people worldwide are turning to prepaid debit cards for convenience, security, and control over their finances. Among the rising stars in this space is the Smione prepaid debit card. Yep, you read that right—Smione. It's like having your own personal financial assistant in your pocket. But before you dive headfirst, let's break it all down for you. What makes Smione stand out from the crowd? Is it worth your time and money? Stick around, because we’re about to spill all the tea.

Now, let's be real here. Prepaid debit cards have been around for a while, but they've evolved so much that they're now more than just a plastic rectangle. They're tools that can help you manage your money smarter, faster, and safer. And when it comes to Smione, the game is truly elevated. This card isn't just about swiping and paying; it's about empowering you to take charge of your finances.

Whether you're a digital nomad, a savvy shopper, or someone who wants to keep their financial life in check, Smione has got your back. So, buckle up, because we’re about to take you on a deep dive into everything you need to know about the Smione prepaid debit card. Let's make sure you're making the right financial decisions, one swipe at a time.

Read also:Jake Ream Rising Star Of The Digital Era

What is the Smione Prepaid Debit Card?

Alright, let's get the basics out of the way first. The Smione prepaid debit card is not your grandma's bank account. It's a modern, tech-savvy solution for anyone looking to simplify their financial life. Unlike traditional debit cards, which are tied directly to your bank account, prepaid cards work by loading funds onto the card in advance. This means no overdraft fees, no hidden charges, and complete control over your spending.

Here's the kicker: Smione takes this concept and turns it up a notch. With features like real-time spending updates, customizable alerts, and seamless integration with mobile apps, Smione makes managing your money as easy as sending a text. Plus, it's accepted everywhere Mastercard is, which, let's be honest, is pretty much everywhere these days.

Why Choose Smione Over Other Prepaid Cards?

Okay, so you're probably thinking, "Sure, but there are tons of prepaid cards out there. Why should I pick Smione?" Great question, my friend. Let's break it down:

- No Monthly Fees: Tired of paying for the privilege of using your own money? Smione has got you covered with zero monthly maintenance fees.

- Global Acceptance: Whether you're grabbing coffee in New York or shopping in Tokyo, Smione works wherever Mastercard is accepted.

- Instant Reloads: Need to add more funds? Smione lets you reload your card instantly through their app, so you're never stuck without cash.

- Security Features: With fraud protection and the ability to lock/unlock your card instantly, your money is safer than ever.

Plus, Smione offers perks like cashback on purchases and exclusive discounts at partner merchants. Who doesn't love saving a buck or two?

Who Should Use the Smione Prepaid Debit Card?

Let's face it, not every financial product is meant for everyone. But Smione is pretty inclusive. Here are some folks who might benefit from using the Smione prepaid debit card:

Young Adults Building Credit

If you're just starting out and trying to build credit, Smione can be a great stepping stone. While it doesn't directly impact your credit score, it helps you learn responsible spending habits without the risk of debt.

Read also:Royce Renee Woods The Rise Of A Social Media Sensation

Travel Enthusiasts

Whether you're jet-setting across continents or road-tripping across states, Smione makes international transactions a breeze. No need to worry about foreign transaction fees or carrying wads of cash.

Small Business Owners

Running a business? Smione can help you manage expenses, track spending, and even separate personal and business funds—all in one convenient package.

How Does Smione Work?

Alright, let's get technical for a sec. Here's how Smione works:

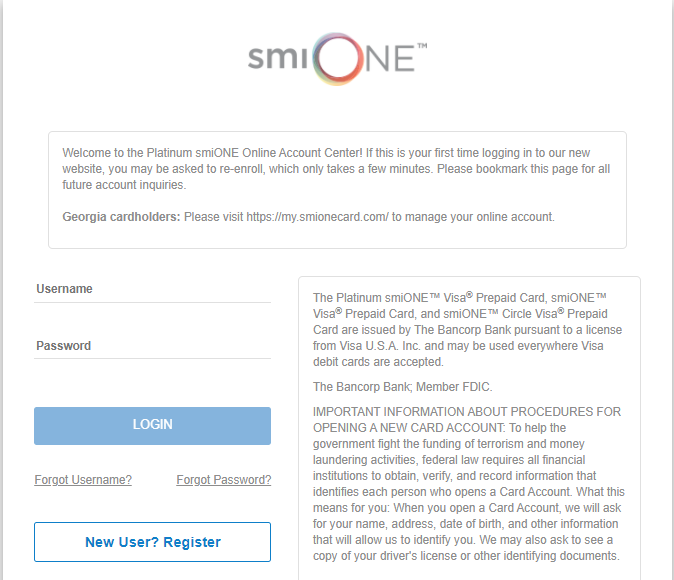

- Sign Up: Download the Smione app, create an account, and verify your identity. It's quick and painless, we promise.

- Load Funds: Add money to your card via bank transfer, direct deposit, or other supported methods.

- Start Swiping: Use your Smione card wherever Mastercard is accepted, both online and offline.

- Track Your Spending: Keep tabs on your transactions through the app, set budgets, and get notified of any suspicious activity.

It's that simple. No complicated jargon, no hidden traps. Just straightforward, user-friendly finance.

Benefits of Using Smione

Let's talk about why Smione is a game-changer in the prepaid debit card world:

1. Control Over Your Finances

With Smione, you're in the driver's seat. Set spending limits, monitor transactions, and adjust your budget as needed. It's like having a financial coach in your pocket.

2. Enhanced Security

Security is a top priority for Smione. Their cards come equipped with chip-and-PIN technology, fraud detection systems, and the ability to freeze your card instantly if it gets lost or stolen.

3. Flexibility and Convenience

Smione offers both physical and virtual card options, so you can choose what works best for you. Need to make an online purchase? Use the virtual card. Want to shop in-store? Grab your physical card and go.

Common Misconceptions About Prepaid Debit Cards

There are a lot of myths floating around about prepaid debit cards, and we're here to set the record straight:

- Myth #1: Prepaid cards are only for people with bad credit. Fact: Anyone can benefit from a prepaid card, regardless of their credit history.

- Myth #2: Prepaid cards are expensive. Fact: Many prepaid cards, including Smione, offer competitive pricing with no hidden fees.

- Myth #3: Prepaid cards aren't secure. Fact: Modern prepaid cards like Smione come with robust security features to protect your funds.

So, don't let these misconceptions hold you back. Prepaid debit cards can be a powerful tool in your financial arsenal.

How to Get the Most Out of Your Smione Card

Now that you know the basics, here are some tips to help you maximize your Smione experience:

Tips for Managing Your Smione Account

- Set Up Alerts: Get notified of transactions, low balances, and suspicious activity to stay on top of your finances.

- Use the App: The Smione app is your one-stop shop for managing your card, viewing transactions, and adjusting settings.

- Plan Your Reloads: Schedule regular reloads to avoid running out of funds when you need them most.

By following these tips, you'll be well on your way to mastering your Smione prepaid debit card.

Smione vs. Competitors

Okay, so how does Smione stack up against other prepaid debit cards on the market? Let's compare:

| Feature | Smione | Competitor A | Competitor B |

|---|---|---|---|

| No Monthly Fees | Yes | No | Yes |

| Global Acceptance | Yes | Yes | No |

| Instant Reloads | Yes | No | Yes |

| Mobile App | Yes | No | Yes |

As you can see, Smione holds its own against the competition, offering a range of features that make it a top choice for prepaid debit card users.

Conclusion: Is Smione Right for You?

So, there you have it—a deep dive into the world of Smione prepaid debit cards. Whether you're a young adult looking to build credit, a globetrotter seeking convenience, or a small business owner managing expenses, Smione has something to offer everyone.

But remember, the key to financial success is finding the right tools for your needs. If Smione sounds like a match made in heaven, why not give it a try? And hey, don't forget to share this article with your friends, drop a comment below, or check out our other finance-related content. After all, knowledge is power, and the more you know, the better you can manage your money.

Final Thoughts: Smione isn't just a prepaid debit card—it's a lifestyle. So, are you ready to take control of your finances and embrace the future of money management? The choice is yours, but we think Smione makes it pretty easy to say yes.

Table of Contents

- What is the Smione Prepaid Debit Card?

- Why Choose Smione Over Other Prepaid Cards?

- Who Should Use the Smione Prepaid Debit Card?

- How Does Smione Work?

- Benefits of Using Smione

- Common Misconceptions About Prepaid Debit Cards

- How to Get the Most Out of Your Smione Card

- Smione vs. Competitors

- Conclusion: Is Smione Right for You?